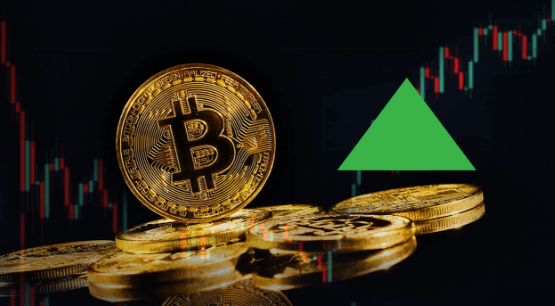

Bitcoin Money Evaluation: Rally Positive Aspects Tempo Above $210

Bitcoin Money Evaluation: Rally Positive Aspects Tempo Above $210 illustrates a significant shift in market dynamics, driven by heightened investor confidence and a notable uptick in institutional interest. This rally not only underscores Bitcoin’s resilience as a digital asset but also raises important questions regarding its long-term viability in the broader financial ecosystem. As we explore the factors fueling this momentum, it becomes essential to consider what this means for potential investors and the implications for future market stability. The unfolding narrative invites a closer examination of the underlying trends shaping Bitcoin’s trajectory.

Current Market Trends

How do current market trends reflect the evolving landscape of Bitcoin?

Recent data indicates a notable shift in market momentum, driven by increasing investor sentiment towards digital currencies.

As institutional adoption rises, Bitcoin’s price demonstrates resilience, suggesting a more robust framework for value retention.

This evolution aligns with a growing demand for financial autonomy, positioning Bitcoin as a key asset in the future financial ecosystem.

Key Factors Driving Growth

The resilience observed in Bitcoin’s price amid increasing institutional adoption is underpinned by several key factors driving its growth.

Notably, rising adoption rates among retail and institutional investors enhance market stability.

Additionally, technological advancements in blockchain scalability and security foster trust and usability.

Collectively, these elements create a favorable environment, promoting wider acceptance and potential for sustained upward momentum in Bitcoin’s valuation.

Read Also Bitcoin Money Evaluation: Rally Positive Aspects Tempo

Implications for Investors

What considerations should investors take into account when navigating the evolving landscape of Bitcoin?

Effective risk management is essential, as volatility can significantly impact returns.

Diversifying investment strategies, such as dollar-cost averaging or allocating a small percentage of a portfolio to Bitcoin, can mitigate potential losses.

Staying informed about market trends and regulatory developments will also empower investors to make proactive decisions in this dynamic environment.

Future Outlook for Bitcoin

As the cryptocurrency market continues to evolve, the future outlook for Bitcoin remains a complex interplay of technological advancements, regulatory frameworks, and market demand.

Price predictions indicate potential upward trends, yet market volatility poses significant risks.

Investors must navigate this uncertainty while considering Bitcoin’s role as a decentralized asset, which may ultimately enhance its appeal in a rapidly changing financial landscape.

Conclusion

Bitcoin Money Evaluation: Rally Positive Aspects Tempo Above $210 underscores a pivotal moment in the cryptocurrency market, driven by increased investor confidence and heightened institutional interest. These factors contribute to a more stable price environment, suggesting significant growth opportunities for market participants. As Bitcoin’s role as a key financial asset solidifies, ongoing analysis of market dynamics will be crucial for understanding future trends. The convergence of these elements points toward a promising trajectory for Bitcoin’s valuation and relevance.